How to Know Your UAN Number Online: A Step-by-Step Guide

The Universal Account Number (UAN) is a crucial identification number for every employee contributing to the Employees' Provident Fund (EPF) in India. This 12-digit number is essential for managing your EPF account, checking your balance, transferring funds, and much more. But what happens when you forget or lose track of your UAN? Thankfully, you can retrieve it online with a few simple steps.

In this article, we'll walk you through the process of how to know your UAN number online. Whether you're a new employee or have been contributing to the EPF for years, this guide will help you access your UAN quickly and easily.

Understanding the UAN: What It Is and Why It Matters

The UAN was introduced by the Employees' Provident Fund Organisation (EPFO) to streamline and simplify the process of managing Provident Fund (PF) accounts. Before the introduction of UAN, employees had to deal with multiple PF account numbers whenever they changed jobs, which made tracking and managing their provident fund contributions quite cumbersome.

Why Is UAN Important?

- Portability: The UAN remains the same throughout your career, irrespective of the number of jobs you change. It ensures that all your PF accounts are linked to a single, unique number.

- Convenience: With your UAN, you can check your PF balance, track your contributions, and even initiate transfers when you switch jobs.

- Transparency: UAN allows employees to monitor their PF accounts online, promoting transparency and ensuring that employers are making the correct contributions.

How to Know Your UAN Number Online

If you’ve forgotten your UAN or are unsure if you ever received it, don’t worry. The EPFO has made it relatively easy to retrieve your UAN online. Here’s a step-by-step guide to help you find your UAN number.

Step 1: Visit the EPFO Member Portal

The first step is to visit the official EPFO Member Portal. This portal is the primary online platform for all EPFO-related activities.

- Open your web browser and go to the official EPFO website.

- Navigate to the ‘For Employees’ section under the ‘Our Services’ dropdown menu.

Step 2: Access the UAN Services

Once you are on the EPFO Member Portal:

- Click on the ‘Member UAN/Online Services’ link.

- You’ll be redirected to the UAN Member e-Sewa portal. This is where you can log in or register to access your UAN-related services.

Step 3: Click on the ‘Know Your UAN’ Option

On the UAN Member e-Sewa portal:

- Look for the option that says ‘Know Your UAN’ and click on it.

- You will be taken to a page where you need to provide your details to retrieve your UAN.

Step 4: Enter Your Personal Details

To retrieve your UAN, you’ll need to enter specific personal information:

- Name: Enter your full name as per your EPF records.

- Date of Birth: Provide your date of birth in the required format.

- Mobile Number: Enter the mobile number that is linked to your EPF account.

- Email ID: Some portals might also ask for your registered email ID.

- Captcha Code: Enter the captcha code displayed on the screen for verification.

After filling in all the details, click on the ‘Submit’ button.

Step 5: Receive Your UAN on Mobile

Once you’ve submitted the form, the portal will verify the details you provided. If the details match the records in the EPFO database, your UAN will be sent to your registered mobile number via SMS.

What If I Don’t Receive My UAN?

In some cases, you might not receive your UAN via SMS. This could happen due to various reasons, such as incorrect details or issues with the EPFO database. If this happens, don’t worry. You can try the following:

- Double-check Your Details: Ensure that the details you entered match those in your EPF records.

- Contact Your Employer: Your employer can provide your UAN if the online method doesn’t work.

- Reach Out to EPFO: You can contact the EPFO helpline or visit the nearest EPFO office for assistance.

Linking Your UAN with Your EPF Account

Once you have retrieved your UAN, it’s crucial to ensure that it is correctly linked to your EPF account. This step is essential for seamless management of your provident fund.

How to Link Your UAN with Your EPF Account

- Log in to the UAN Member e-Sewa Portal: Use your UAN and password to log in.

- Navigate to the ‘KYC’ Section: Under the ‘Manage’ tab, select ‘KYC’ to update your details.

- Add Your Bank, PAN, and Aadhaar Details: Ensure that your UAN is linked with your bank account, PAN, and Aadhaar for easy withdrawals and fund transfers.

Linking your UAN with these details not only simplifies the withdrawal process but also ensures that your EPF account is compliant with KYC norms.

How to Check Your UAN Status

If you are unsure whether your UAN is active or linked correctly, you can easily check its status online.

Steps to Check Your UAN Status

- Visit the UAN Status Page: Go to the EPFO website and navigate to the ‘Know Your UAN Status’ page.

- Enter Your Details: Provide your EPF account number, name, date of birth, and other required details.

- Submit the Form: After entering the details, click on ‘Submit’.

- Check the Status: You will receive a message on the screen displaying the status of your UAN.

If your UAN is active, you can proceed to log in to the UAN Member e-Sewa portal to manage your EPF account.

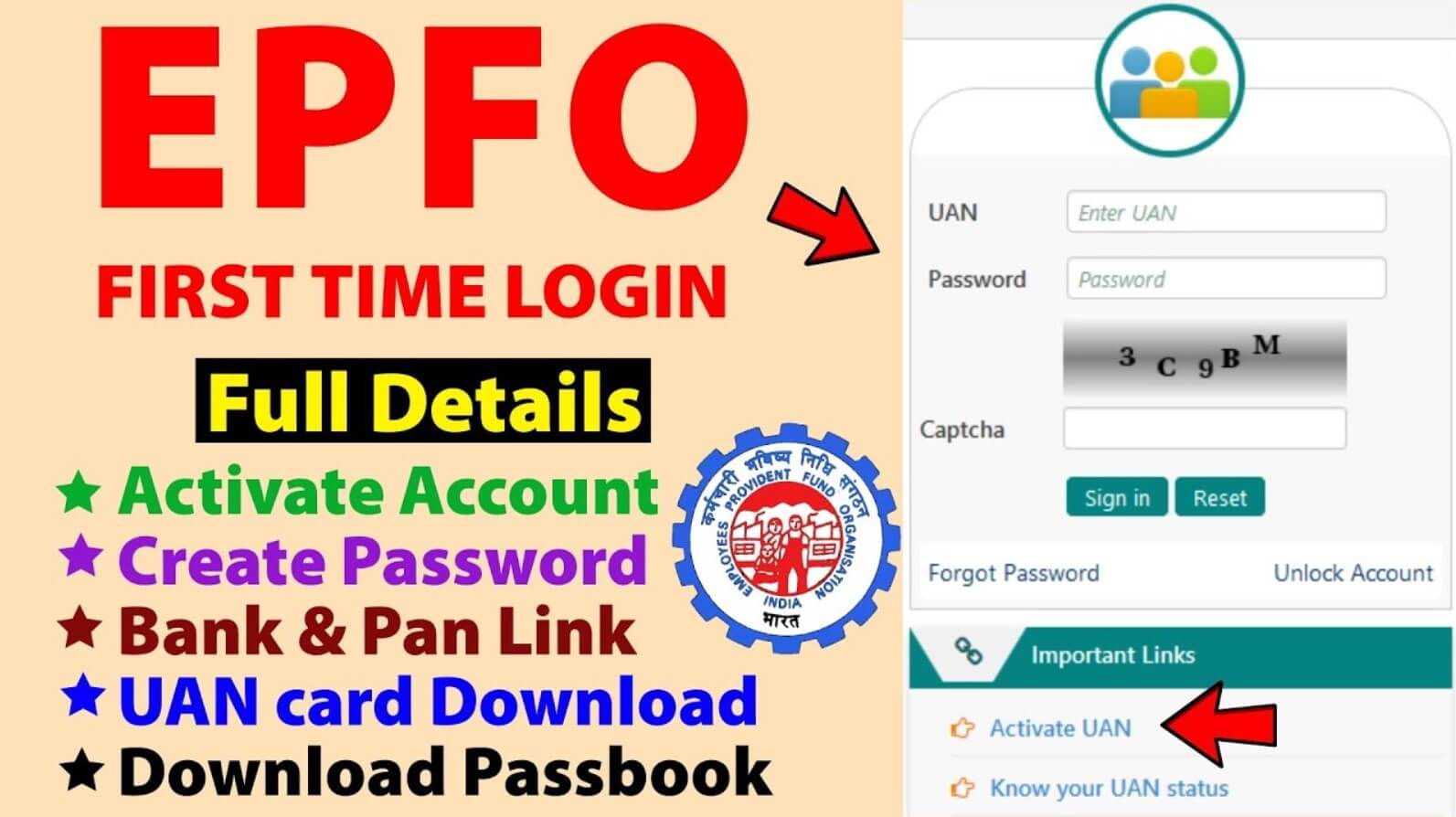

How to Activate Your UAN Online

Once you have your UAN, the next step is to activate it. Activating your UAN allows you to access your PF account online, check balances, and manage your account.

Steps to Activate Your UAN

- Visit the EPFO Member Portal: Log in to the UAN Member e-Sewa portal.

- Click on ‘Activate UAN’: You’ll find this option on the login page.

- Enter the Required Information: Provide your UAN, member ID, and mobile number.

- Complete the Captcha: Enter the captcha code and click on ‘Get Authorization PIN’.

- Enter the OTP: An OTP will be sent to your registered mobile number. Enter this OTP on the portal.

- Activate Your UAN: Once you submit the OTP, your UAN will be activated. You will receive a password on your mobile number, which you can use to log in.

Managing Your PF Account Online Using UAN

Now that you have activated your UAN, you can manage your PF account online with ease. Here’s what you can do:

Check PF Balance

One of the key features of the UAN portal is the ability to check your PF balance online.

- Log in to the UAN Portal: Use your UAN and password.

- Navigate to the ‘Passbook’ Section: Click on ‘View’ and select ‘Passbook’.

- Check Your Balance: Your passbook will display the balance and transaction history of your PF account.

Initiate PF Transfers

If you change jobs, you can transfer your PF balance from your old account to the new one linked with your UAN.

- Log in to the UAN Portal: Use your credentials to access your account.

- Go to the ‘Online Services’ Tab: Click on ‘Transfer Request’.

- Enter Details: Fill in the details of your previous and current employer.

- Submit the Transfer Request: After submitting, your request will be processed, and the balance will be transferred.

Download Your UAN Card

Your UAN card is a digital identity card for your PF account. You can download it easily:

- Log in to the UAN Portal: Enter your details to access your account.

- Go to the ‘UAN Card’ Section: Click on the option to download your UAN card.

- Save or Print the Card: You can save it on your device or print it for your records.

Common Issues and Troubleshooting

While the process of retrieving and managing your UAN online is generally smooth, you might encounter a few issues. Here’s how to troubleshoot some common problems:

Forgot UAN Password

If you forget your UAN password, you can reset it easily.

- Go to the UAN Login Page: Click on ‘Forgot Password’.

- Enter Your UAN and Captcha: Provide the necessary details.

- Verify with OTP: Enter the OTP sent to your registered mobile number.

- Reset Your Password: Create a new password and confirm it.

Mismatch in Personal Details

Sometimes, the details you enter might not match the EPFO records, leading to errors.

- Check with Your Employer: Ensure that your employer has submitted the correct details to the EPFO.

- Update Your Details: If there’s a mismatch, you can update your details online through the ‘Profile’ section on the UAN portal.

No UAN Linked to EPF Account

In rare cases, you might find that your EPF account is not linked to any UAN.

- Contact Your Employer: Request them to link your EPF account with a UAN.

- Visit the EPFO Office: If the issue persists, visit the nearest EPFO office for assistance.

The Role of Employers in UAN Management

Employers play a significant role in the management and linking of UANs. They are responsible for generating UANs for new employees and ensuring that all contributions are correctly credited to the employee’s EPF account.

Employer Responsibilities:

- Generating UAN: For new employees, the employer must generate a UAN through the EPFO portal.

- Linking EPF Accounts: Employers must link the employee’s EPF account to their UAN and update the necessary KYC details.

- Ensuring Timely Contributions: Employers are also responsible for making timely contributions to the employee’s PF account.

What to Do If Your Employer Hasn’t Generated Your UAN?

If your employer hasn’t generated your UAN, you can:

- Request Your Employer: Ask your HR department to generate your UAN.

- Contact EPFO: If your employer doesn’t comply, you can contact the EPFO directly for assistance.

The Importance of Keeping Your UAN and EPF Details Secure

Your UAN and EPF details are sensitive information that should be kept secure to prevent unauthorized access to your account.

Tips for Securing Your UAN:

- Never Share Your Password: Keep your UAN portal password confidential.

- Use Strong Passwords: Create a strong, unique password for your UAN account.

- Regularly Update Your KYC Details: Ensure that your bank, PAN, and Aadhaar details are up-to-date to prevent fraud.

FAQs

How can I know my UAN number if I have changed my mobile number?

If you've changed your mobile number, you can retrieve your UAN by updating your mobile number through your employer or by visiting the EPFO office.

Can I get my UAN number through my employer?

Yes, your employer can provide you with your UAN number. They can also help link your EPF account with your UAN.

What should I do if I find multiple UANs linked to my EPF account?

If you have multiple UANs, you should inform the EPFO immediately. They will deactivate the redundant UANs and link your PF accounts to the correct UAN.

Is it possible to retrieve my UAN number without a mobile number?

Retrieving your UAN without a registered mobile number is challenging online. However, you can visit the EPFO office with your identification documents to get assistance.

How long does it take to get my UAN number after submitting my details online?

You should receive your UAN number instantly via SMS if your details match the EPFO records. If there are discrepancies, it may take longer, and you may need to contact your employer or the EPFO.

Can I activate my UAN without linking my Aadhaar?

Linking your Aadhaar with your UAN is recommended for KYC compliance and smooth management of your PF account. While activation without Aadhaar might be possible, it may limit certain services.

Conclusion

Knowing your UAN number is essential for managing your EPF account efficiently. With the convenience of online services provided by the EPFO, retrieving and managing your UAN has become straightforward. By following the steps outlined in this guide, you can easily know your UAN number online, activate it, and keep your provident fund details secure. Whether you’re a new employee or someone managing multiple PF accounts, understanding and utilizing your UAN is crucial for your financial well-being.

Remember, your UAN is your gateway to managing your retirement savings, so keep it safe and make sure it's always up to date. If you encounter any issues, don’t hesitate to seek help from your employer or the EPFO. With your UAN in hand, you're well on your way to a secure and well-managed retirement fund.