Honest Review of Cashfree Payment Gateway

Choosing the right payment gateway can be a game-changer for businesses. With the digital payment landscape evolving rapidly, businesses must ensure they select a platform that is reliable, secure, and offers seamless integration. One such payment gateway that has garnered significant attention is Cashfree. This article provides an honest review of Cashfree Payment Gateway, detailing its features, benefits, pricing, and real user experiences to help you make an informed decision.

Overview of Cashfree Payment Gateway

Cashfree is a comprehensive payment solution designed to simplify the payment process for businesses of all sizes. Founded in 2015, Cashfree has quickly become one of the leading payment gateways in India, known for its quick integration, robust security features, and diverse payment options. It offers businesses the ability to accept online payments, disburse payments, and manage bulk transactions efficiently.

Features of Cashfree Payment Gateway

1. Wide Range of Payment Options Cashfree supports multiple payment methods, including credit/debit cards, net banking, UPI, wallets, and international payments. This flexibility ensures that businesses can cater to a diverse customer base.

2. Quick Integration One of the standout features of Cashfree is its quick and easy integration process. With detailed documentation, plugins, and SDKs available for various platforms, businesses can get started with minimal technical hassle.

3. Payouts Cashfree’s Payouts feature allows businesses to disburse funds to bank accounts, UPI IDs, and wallets in real-time. This is particularly useful for businesses that need to process refunds, vendor payments, or employee salaries.

4. Instant Settlements Unlike many other payment gateways that take a day or more to settle funds, Cashfree offers instant settlements, providing businesses quicker access to their money.

5. Subscription Management Cashfree supports recurring billing and subscription management, making it an ideal choice for SaaS businesses and subscription-based services.

6. Advanced Security Security is a top priority for Cashfree. The platform is PCI DSS Level 1 compliant and uses advanced fraud detection tools to ensure that transactions are secure.

7. Smart Analytics Cashfree provides detailed analytics and reports, helping businesses track their payment performance, identify trends, and make data-driven decisions.

Benefits of Using Cashfree Payment Gateway

[embed]https://youtu.be/ECwGBJmEy5E[/embed]

1. Cost-Effective Cashfree offers competitive pricing with transparent fee structures, making it a cost-effective choice for businesses looking to manage their payment processing expenses.

2. Enhanced User Experience With a user-friendly interface and seamless payment process, Cashfree enhances the overall user experience, leading to higher customer satisfaction and retention rates.

3. Versatility Cashfree’s versatility in supporting various payment methods and its ability to handle bulk transactions make it suitable for a wide range of industries, from e-commerce to financial services.

4. Reliable Customer Support Cashfree is known for its responsive customer support, offering businesses the assistance they need to resolve issues quickly and efficiently.

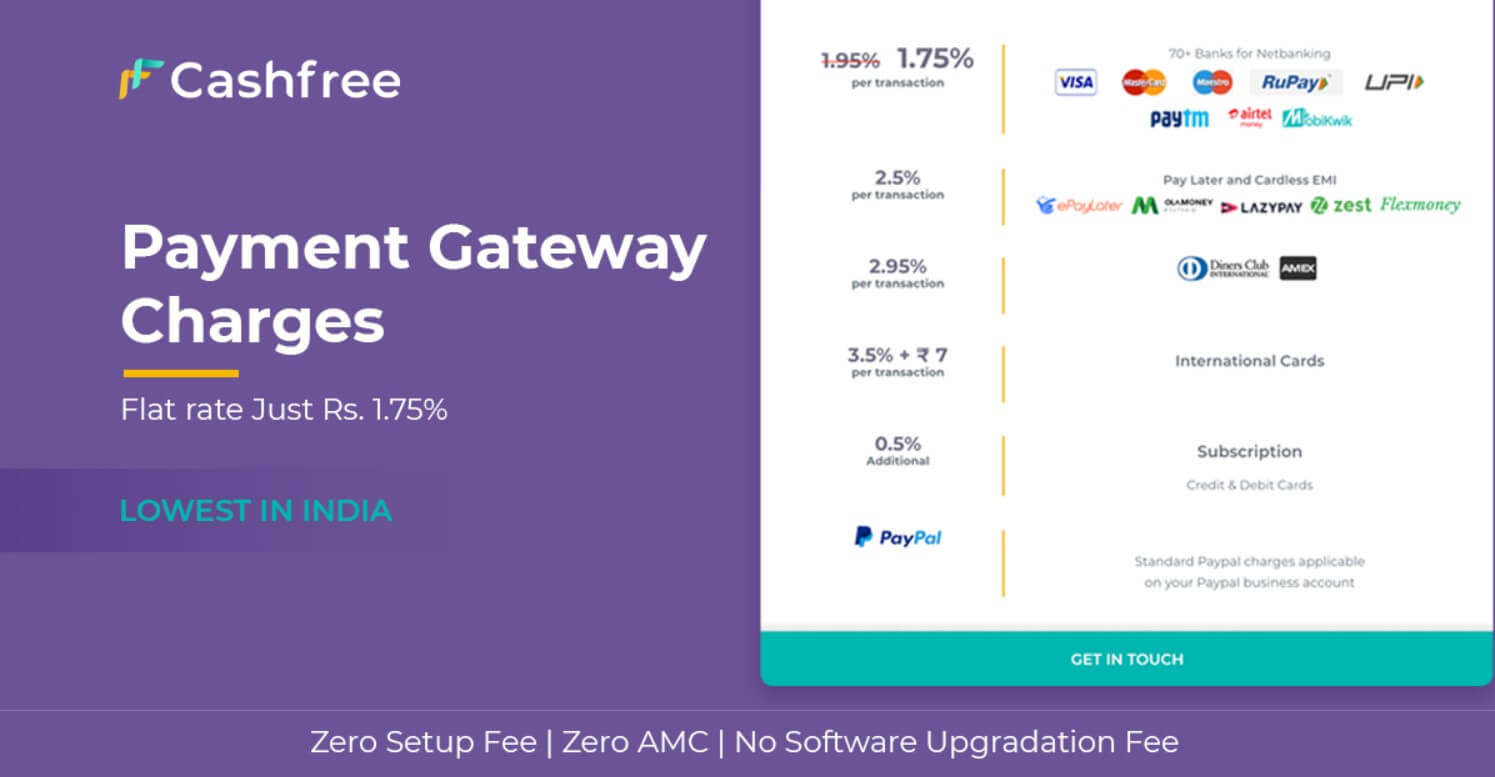

Pricing and Fees

Cashfree’s pricing model is straightforward and competitive. Here’s a breakdown of the main charges:

1. Transaction Fees

- Credit/Debit Cards: 2% per transaction

- Net Banking: 1.75% per transaction

- UPI: 0% up to ₹50,000, 2% beyond that

- Wallets: 2.5% per transaction

- International Cards: 3.5% per transaction + ₹7 per transaction

2. Payouts Fees

- Bank Account: ₹3 per transaction

- UPI ID: ₹3 per transaction

- Wallet: ₹3 per transaction

3. Additional Fees

- Refund Fees: No charge

- Chargeback Fees: ₹500 per chargeback

These competitive rates make Cashfree an attractive option for businesses looking to optimize their payment processing costs.

User Experiences and Reviews

Positive Experiences Many users have praised Cashfree for its easy integration process and reliable performance. Businesses particularly appreciate the instant settlement feature, which allows for better cash flow management. The wide range of supported payment methods and the platform’s robust security measures are also frequently highlighted in positive reviews.

Areas for Improvement Some users have noted occasional delays in customer support response times. Additionally, while the platform is generally reliable, a few users have experienced technical glitches during high-traffic periods. However, these instances are relatively rare and are often swiftly addressed by the Cashfree support team.

How to Get Started with Cashfree

1. Sign Up and KYC Verification To start using Cashfree, businesses need to sign up on the Cashfree website and complete the KYC verification process. This involves providing business details and necessary documentation for verification.

2. Integration Once verified, businesses can integrate Cashfree with their website or app using the provided APIs, SDKs, or plugins. Cashfree supports integration with popular platforms such as Shopify, WooCommerce, Magento, and more.

3. Go Live After integration, businesses can start accepting payments immediately. Cashfree provides a sandbox environment for testing before going live to ensure everything works smoothly.

4. Monitoring and Optimization Businesses can use Cashfree’s dashboard to monitor transactions, generate reports, and optimize their payment processes based on the insights provided.

Comparing Cashfree with Other Payment Gateways

1. Razorpay Razorpay is another popular payment gateway in India. While both Cashfree and Razorpay offer similar features, such as multiple payment options and quick integration, Cashfree stands out with its instant settlement feature and competitive pricing.

2. PayU PayU is known for its extensive international payment support. However, Cashfree offers a more user-friendly interface and better customer support, making it a preferred choice for many small to medium-sized businesses.

3. Instamojo Instamojo is ideal for small businesses and individual sellers due to its simple setup process. However, for businesses that require advanced features like bulk payouts and subscription management, Cashfree is the better option.

FAQs

What is Cashfree Payment Gateway?

Cashfree is a payment gateway that provides businesses with solutions to accept online payments, disburse funds, and manage bulk transactions efficiently.

How secure is Cashfree?

Cashfree is PCI DSS Level 1 compliant and uses advanced fraud detection tools, ensuring that all transactions are secure.

Can Cashfree handle international payments?

Yes, Cashfree supports international payments, allowing businesses to accept payments from customers worldwide.

What is the settlement time for Cashfree?

Cashfree offers instant settlements, providing businesses with quick access to their funds.

Is there a setup fee for Cashfree?

No, Cashfree does not charge any setup fees. Businesses only pay transaction and payout fees based on their usage.

How does Cashfree’s customer support compare to other payment gateways?

Cashfree is known for its reliable and responsive customer support, often praised by users for its efficiency and effectiveness.

Conclusion

Cashfree Payment Gateway offers a robust, secure, and user-friendly solution for businesses looking to streamline their payment processes. With its wide range of supported payment methods, quick integration, competitive pricing, and exceptional customer support, Cashfree stands out as a top choice for businesses in India and beyond. Whether you are a small business or a large enterprise, Cashfree provides the tools and features needed to manage your payments efficiently and effectively.